March 2020

Whatever the market conditions, it’s important to have the right tools to manage risk. Our long (TECC) and short (TECS) iTraxx Crossover ETFs allow investors to increase or decrease their European high yield credit exposure, without trading underlying bonds and without adding or removing interest rate risk.

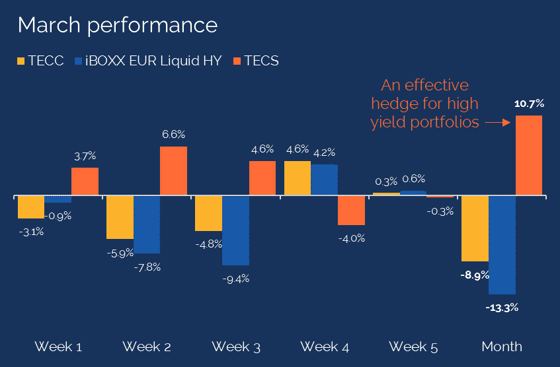

The volatility in March highlighted the effectiveness of TECS as a hedging tool. The ETF showed strong inverse correlation with both long CDS exposure and with European high yield bond benchmarks, on both a weekly and a monthly basis.

Past performance is not a reliable indicator of future performance.

Find out more

Read our latest updates

The market turmoil in March and credit liquidity crisis led some fixed income ETFs to trade at discounts to their underlying NAVs. Tabula's ETFs take steps to address these index construction concerns. Find out more: Fixed Income ETF NAV discounts explained

In March, IHS Markit's iTraxx European indices rolled to new index series affecting Tabula's corporate bond fund, the Tabula iTraxx IG Bond UCITS ETF. Find out more: Tabula IG Bond ETF Index roll

How did our ETFs perform in March?

| Tabula European Performance Credit (EUR) Acc | -8.7% | See the factsheet > | ||

| Tabula European iTraxx Crossover Credit (EUR) Acc | -8.9% | See the factsheet > | ||

| Tabula European iTraxx Crossover Credit Short (EUR) Acc | +10.7% | See the factsheet > | ||

|

Tabula iTraxx IG Bond (EUR) Dist1

|

-6.0% | See the factsheet > | ||

|

Tabula J.P. Morgan Global Credit Volatility Premium (EUR) Acc

|

-7.8% | See the factsheet > |