|

26 March 2020 Recent market turmoil has led fixed income ETFs to trade at discounts to their underlying NAVs, with some funds trading at discounts as high as 11%. NAV discounts are a reflection of a dislocation between the trading of the underlying basket and the pricing of the individual underlying securities owned by the fund. This phenomenon highlights the potential issues of illiquidity in index construction of many “so called” core bond ETFs, posing a valuation risk to investors that is often overlooked in calm markets. These ETFs typically replicate indices that are a broad reflection of a segment of the market and apply wide selection criteria, thus creating large portfolios weighted by market capitalisation of debt. Tabula's ETFs take steps to address these index construction concerns.

Addressing these in turn, Tabula’s credit ETFs, set out below, track CDS Index benchmarks by either trading CDS index contracts or sampling the index by buying bonds of the issuers contained within the index. Tabula CDS-based ETFs

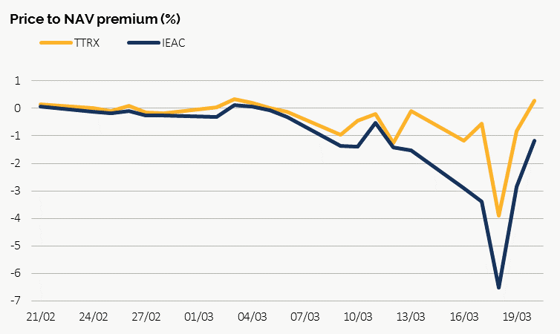

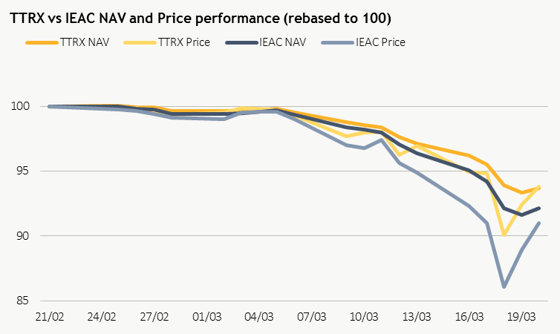

CDS indices are the most liquid fixed income instruments, even more so in the context of market stress. There were no intra-day dislocations between the pricing on Tabula’s CDS-based ETFs and the underlying indices. In contrast, the Tabula iTraxx IG Bond UCITS EFT (TTRX) follows a cash corporate bond benchmark based on the iTraxx Europe CDS index composition, so it is exposed to the potential for NAV discounts. However, TTRX has both outperformed and traded closer to its index in the last three weeks compared to broad Euro IG funds that replicate benchmarks such as the Bloomberg Barclays Euro Corporate Index, for example IEAC (the largest European Euro IG ETF). As a cash bond mirror to the iTraxx Europe Index, TTRX offers more precise and concentrated exposure. Due to this approach it provides a less sampled European IG market portfolio helping explaining its lower discount:

|

|||||||||||

Source: Tabula and Bloomberg Please get in touch if you would like to discuss further. |

|||||||||||

|

|||||||||||