For professional investors only

While equity markets appeared to enjoy a recovery in May and June, corporate defaults provided a cold dose of reality. Tabula CIO Jason Smith looks at the outlook for North American corporate credit and how investors can manage their risk.

|

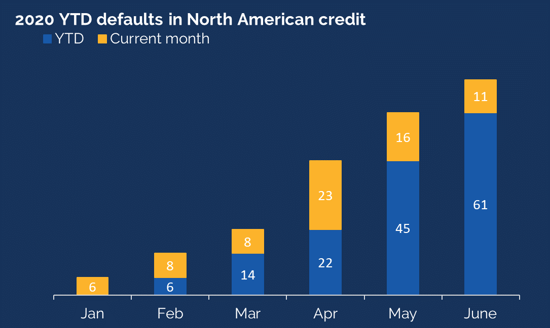

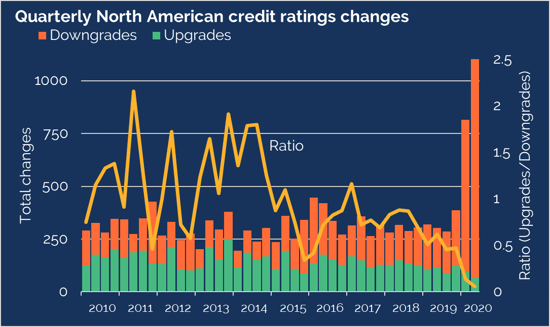

Key Takeaways - YTD defaults in North American corporate credit are the highest since 2009 - Ratings downgrades have accelerated sharply - Default rates may not peak until 2021 - In a rapidly evolving situation, the ability to reduce exposure quickly and efficiently is critical |

Defaults on the rise

If you were following equity markets in May and June, you could be forgiven for forgetting that we’re in the midst of a global pandemic and one of the worst economic downturns on record. Credit markets, however, are more revealing. So far in 2020, North America has seen the highest number of defaults since 2009.

Source: Tabula, S&P and Bloomberg, 30 June 2020

US corporates weren’t healthy even before COVID-19

Downgrades are often the warning signs for defaults. As the chart below shows, downgrades in US corporate credit had accelerated sharply in Q4 2019, before the COVID-19 outbreak and continued to rise as the pandemic took hold.

The outlook from the rating agencies isn’t pleasant reading either, particularly for high yield investors. In March, Fitch raised its 2020 “base case” default rate for US high yield to 5-6%, with a “severe case” forecast of up to 10%, highlighting the energy sector as particularly vulnerable. Moody’s optimistic scenario, published in April, sees defaults in North American speculative credit peaking at over 13% in March 2021. Their pessimistic scenario is for well over 20%.

Source: Tabula, S&P and Bloomberg, 30 June 2020

Expecting (and managing) the unexpected

The current outlook for US high yield looks fragile, but we are also in a situation that is changing fast. Who knows what will happen in the next six months? We could see rescue packages for the US energy sector, vaccines available in record time and a sharp economic recovery. Or we could see an ongoing economic downturn and difficult conditions in many sectors.

It’s worth remembering that the composition of the high yield market is changing too. Fallen angels have already enlarged the US high yield market by over 15% this year. Multiple studies show that fallen angels are more likely to default than original high yield issuers, as they face higher borrowing costs. However, as historically stronger companies, some are also more likely to be upgraded to investment grade. How these newly-fallen angels fare is another source of uncertainty.

In such uncertain times for the high yield market, the ability to quickly reduce exposure is critical. The new Tabula North American CDX High Yield Credit Short UCITS ETF provides efficient short exposure to US high yield, without the need for ISDAs or sourcing of securities to borrow. In the coming months, this could be a valuable tool for any portfolio manager with a US high yield allocation. The ETF could also be a good hedge for correlated, but less liquid assets like leveraged loans.

Click here to find out more about the Tabula North American CDX High Yield Credit Short UCITS ETF and our other long and short credit ETFs.

Jason Smith, Chief Investment Officer