FOR PROFESSIONAL INVESTORS ONLY

What can we learn from science-based targets?

The EU’s new Paris-Aligned Benchmarks come with an ambitious requirement to reduce greenhouse gas (GHG) emissions by 7% per annum. This raises some interesting questions about the evolution of these indices, and the funds that track them. Will managers be forced to choose from a shrinking pool of assets to meet the targets or will widespread decarbonisation allow these indices to become increasingly diverse and representative of the broader market? Science-based targets do not form part of the index construction behind the Tabula EUR IG Bond Paris-aligned Climate UCITS ETF (the “ETF”). However, they can provide some useful insights into how the ETF could evolve in the future.

What are science-based targets?

A company’s GHG emissions targets are considered ‘science-based’ if they are in line with what the latest climate science deems necessary to meet the goals of the Paris Agreement, i.e. limiting global warming to well below 2°C above pre-industrial levels, and pursuing efforts to limit warming to 1.5°C.

The Science Based Targets Initiative (SBTi) is a partnership between CDP (previously the Carbon Disclosure Project), the United Nations Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF). It aims to mobilise the private sector by helping companies to set science-based targets and providing expert assessment and validation of those targets. Targets must cover scope 1 and 2 emissions, plus scope 3 emissions where these are more than 40% of a company’s total emissions.

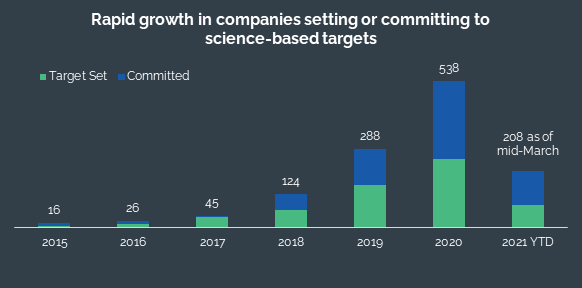

So far, over 1200 companies have either set targets or committed to target setting, and these numbers are growing fast.

Data: Science Based Targets Initiative, 15 March 2021

How does the Euro IG bond market measure up?

To qualify for the EU Paris-Aligned Benchmark (or “PAB”) label, a fund or index must cut emissions by 50% relative to the broader market at inception and by at least 7% per annum thereafter. These requirements have raised concerns that managers will find it increasingly more and more difficult to achieve a diversified portfolio. These 50% and 7% reductions apply at the portfolio level, not for individual issuers. However, looking at individual issuers and their decarbonisation plans can give us some useful insights. For Tabula’s Paris-aligned Euro IG ETF, we can look at this in two ways:

- Which issuers currently in the ETF have set or committed to targets? If these issuers meet their commitments, they could have a positive impact on the ETF’s annual 7% emissions reduction, and potentially see their weighting increase.

- Which issuers currently excluded from the ETF have set or committed to targets? Many energy companies are currently excluded because of their use of fossil fuels. If these companies set targets and implement them by reducing their use of fossil fuels, they could become eligible for the ETF and improve its diversification.

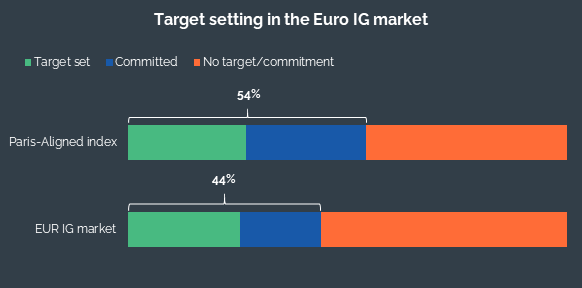

Although the number of companies setting science-based targets is still relatively small, many of these companies are in Europe. As a result, the picture in the Euro investment grade bond market is quite promising. Over 50% of the index referenced by Tabula’s Paris-Aligned ETF, by index weight, has set or committed to a science-based target, and over 40% of the wider Euro IG universe. Given the huge momentum in target setting, we can only expect these percentages to increase. The more issuers set targets, and go on to implement those targets, the easier it will be for Tabula’s ETF to meet its decarbonisation goals.

Data: Tabula / Solactive / Science Based Targets Initiative, 15 March 2021. Paris-Aligned Index is the Solactive ISS Paris Aligned Select Euro Corporate Bond Index. EUR IG market is represented by the Solactive EUR IG Corporate Index. Percentages are based on index weight.

A deeper dive (into cement)

An interesting case study is Heidleberg Cement. This company is one of the world’s major emitters of greenhouse gases. As a result, people are sometimes surprised at its high weighting in Tabula’s Paris-aligned ETF and the underlying Solactive ISS Paris Aligned Select Euro Corporate Bond Index. The index mechanics explain Heidleberg’s current inclusion and weighting: it is included because it passes all the ESG screens; and it has a high weighting because of the index’s diversification constraints, including a requirement that sector weights are within 5% of their weight in the wider Euro IG market. However, looking at the company’s sustainability objectives, while not part of the index construction, can give us some insights into its role in the index, now and in the future.

The good news is that, in May 2019, Heidelberg was the first cement company to have targets validated and approved by the SBTi. It had already achieved significant reductions in emissions per ton of cement between 1999 and 2019 and is now aiming for carbon-neutral cement production by 2050. Its strategy revolves around alternative fuels, alternative raw materials (including recycled materials) and carbon capture. The SBTi validation gives us some confidence that the company is committed to meeting its targets. The less-good news is that these targets are currently aligned only with a 2C scenario, rather than a 1.5C scenario. However, all else equal, if Heidelberg Cement reduces its emissions year on year, it can potentially contribute to the overall decarbonisation of the index.

The path to inclusion for energy companies

The PAB methodology makes it difficult to include the majority of energy companies because it imposes strict limits on revenues from fossil fuels (1% for coal, 10% for oil and 50% for gas and GHG-intensive electricity production). As a result, in Tabula’s ETF, the energy sector is typically around 5% underweight relative to the broader market – the maximum deviation allowed by the index rules.

One example of an excluded issuer, with fossil fuel revenues slightly over the permitted threshold, is EDF, the French energy supplier. By setting science-based targets in late 2020, EDF has provided a clear picture of its future commitments: a 50% reduction in scope 1 and 2 GHG emissions between 2017 and 2030, as well as a 28% reduction in scope 3 GHG emissions from use of sold product between 2019 and 2030. It can only meet these targets by further reducing its use of fossil fuels. We can therefore expect EDF to qualify for the Tabula ETF at some point in the future, improving the diversification of the ETF’s energy exposure.

What we’ve learnt

Although the PAB methodology is ambitious, it doesn’t force the exclusion of carbon-intensive companies as long as the overall index or ETF is still Paris-Aligned overall. We already knew that those companies were contributing to diversification, helping to ensure an ETF’s suitability for core allocations and its appeal to a broad range of investors. However, by looking at indicators like science-based targets, we can gauge whether those companies are also likely to make a positive contribution to the ETF’s future decarbonisation. Likewise, by looking at the targets of companies currently outside the index - particularly in the energy sector – we are better able to gauge which are likely to be on track to reduce their use of fossil fuels and potentially become eligible for index inclusion.

The rapid growth in companies setting science-based targets is good positive indicator, both for the ability of PABs to meet their 7% annual decarbonisation target and for the wider Paris goals. Of course, we still need many more companies to set targets, and for all those targets to be met. If that happens, then the ambition of meeting the Paris goals could be become reality.

Find out more about the Tabula EUR IG Bond Paris-aligned Climate ETF.

The fund has a sustainable investment objective with a designated index that seeks to reduce carbon emissions, which makes it eligible to Article 9 (SFDR).