A new ETF designed to capture both realised and expected inflation

Existing inflation ETFs force investors to choose between realised inflation or inflation expectations. Both approaches provide inflation exposure, but require investors to make compromises, or double their capital allocation.

Existing solutions:

|

Realised US inflation ETFs |

Expected US inflation ETFs |

| A portfolio of TIPS | Long TIPS, short US Treasuries |

| ✓ Good long-term inflation protection ✗ Little sensitivity to changing inflation expectations/breakevens ✗ Significant interest rate exposure (problematic as rising inflation often coincides with rising rates) |

✓ Good sensitivity to breakeven inflation ✓ No interest rate exposure ✗ No carry/real yield ✗ More suitable for an overlay than a funded inflation strategy |

Our solution:

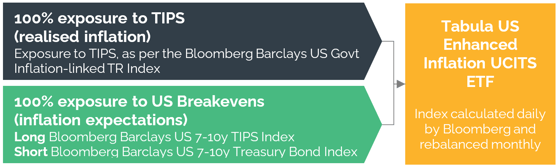

- Meaningful inflation protection with real yield: 100% exposure to realised inflation and 100% exposure to expected inflation

- A broad portfolio of US inflation-linked bonds (TIPS) delivering realised inflation

- A derivatives overlay providing 7-10y US inflation expectations, duration hedged

- A liquid, low cost UCITS ETF: trades intraday and can be used for long-term allocations or tactical trades

Resources

Key terms

| ETF name: | Tabula US Enhanced Inflation UCITS ETF (USD) |

|

| Index: | Bloomberg Barclays US Enhanced Inflation Index |

|

| Index ticker: | H35616US Index | |

| Replication: | Direct |

|

| Base currency: | USD |

|

| Share classes: | USD Accumulating | EUR-Hedged Accumulating |

| Ticker: | TINF | TINE |

| Exchange: | LSE | Borsa Italiana |

| ISIN: | IE00BMDWWS85 | IE00BKX90X67 |

| OCF: | 0.29% | 0.34% |

| Domicile: | Ireland |

|