MARKETING COMMUNICATION FOR PROFESSIONAL INVESTORS ONLY

We take a closer look at the Bloomberg US Enhanced Inflation Index, which combines traditional inflation-linked bonds with an extra layer of breakeven inflation

Why TIPS alone may not be optimal

Inflation-linked bonds are an established way to protect against inflation. In the US, Treasury Inflation Protected Securities, or TIPS, have been issued since 1997. They are currently issued in 5, 10 and 30-year maturities, with the principal and coupon amounts adjusted to reflect changes in the US Consumer Price Index (CPI). There are many indices tracking TIPS, and many ETFs tracking those indices. TIPS provide good long-term inflation protection. However, they do have a few drawbacks for investors.

The first is that TIPS, like other bonds, have inherent interest rate risk. Since rising inflation often coincides with rising interest rates, the benefits of TIPS may sometimes be offset by the negative impact of their duration. If you are invested solely in government bonds, this may not matter – by using TIPS, you get inflation protection on top of the return (positive or negative) that you would have received if you had held standard US Treasuries instead. However, in practice, many investors use TIPS indices and ETFs for broader portfolio protection. In the current environment, where US inflation is high and interest rate hikes look likely, TIPS alone may not be the best solution.

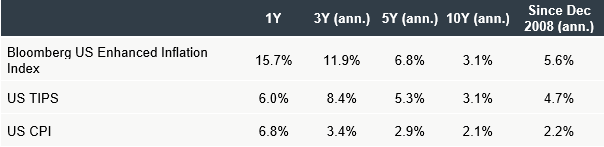

The second drawback is that TIPS have little exposure to inflation expectations and can therefore be slow to react to an inflationary environment. 2021 provides a good example of this. Concerns about inflation were widespread and, in the end, US CPI rose by 6.8% over the year. However, a TIPS portfolio tracking the Bloomberg US Treasury Inflation-Linked Bond Index would have returned only 6%. If you are looking to TIPS to provide inflation protection only for a US government bond allocation, this may not be problematic. If you are using TIPS to provide broader inflation protection, this return would have been disappointing.

Incorporating inflation expectations

Taking exposure to expected inflation, as well as to TIPS, can reduce both these drawbacks. Expected inflation is important to both economists and investors, partly because it can be self-fulfilling. If you are expecting prices to rise, you might decide to buy a car now rather than later. But increased demand for cars now could actually drive prices up, causing the inflation that was previously expected. As a result, inflation expectations are often a precursor to actual inflation. By incorporating these expectations, your portfolio can be more reactive to changing inflation scenarios.

Although it can be measured by surveys, the financial market’s expectations of inflation are most easily measured by the difference between the nominal bond yield and the inflation-linked bond yield on government bonds of the same maturity. This measure is known as “breakeven inflation”, as it reflects the level of inflation at which the return on both bonds would be the same. Importantly, breakeven inflation isolates the component of the nominal bond yield that is not related to credit or interest rate risk. As a result, adding breakeven exposure to your portfolio does not add interest rate duration.

Constructing an “enhanced” inflation index

Typically, investors looking to add breakeven inflation to their portfolios would need to enter into inflation swap contracts with their broker. For many investors, this is both inconvenient and operationally complex. The Bloomberg US Enhanced Inflation Index provides exposure to TIPS and US breakeven inflation in a single index.

The index has two components, with 100% exposure to each:

A simple US TIPS index, the Bloomberg US Govt Inflation-Linked All Maturities Total Return Index. This gives TIPS exposure across a range of maturities, similar to a traditional US TIPS ETF.

7-10 year breakeven inflation, achieved via a long position in the Bloomberg US Govt Inflation-Linked 7-10Y Total Return Index and a short position in the Bloomberg US Treasury 7-10y Total Return Index. The choice of 7-10y is for two related reasons: firstly, it is the area on the inflation curve that investors and economists are usually most focused on; secondly, it is the most liquid.

The resulting index can be replicated by an ETF or other passive investment via a portfolio of TIPS and, for the breakeven component, an Over-the-Counter swap, creating an efficient and convenient “all-in-one-solution” for investors.

Comparing performance characteristics

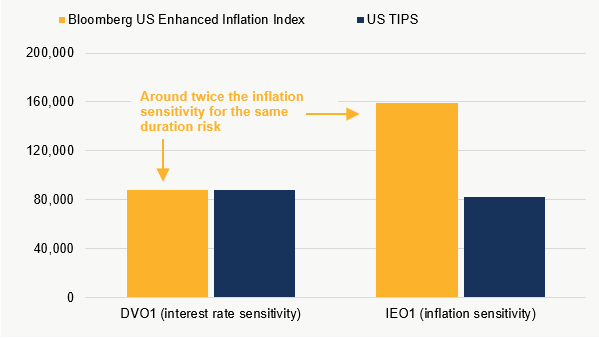

The Bloomberg US Enhanced Inflation Index provides two types of inflation exposure in a single index. A good way to understand its characteristics is to look at how it reacts to changes in the two key metrics: US interest rates and US CPI (Consumer Price Index). As Chart 1 shows, the Enhanced Inflation Index has almost twice the sensitivity to changes in inflation as a pure TIPS index, but with the same interest rate duration. As an investor, you can interpret this in two different ways depending on your objectives. Either you get more inflation exposure for the same duration risk, or you get the same inflation exposure for half the duration risk.

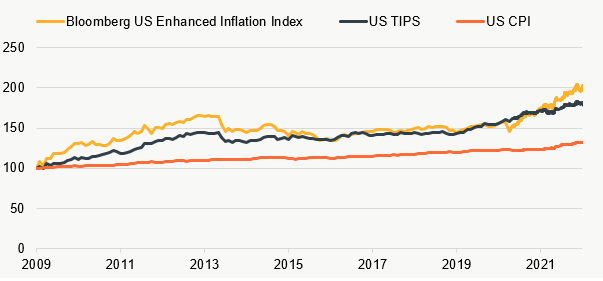

If we return to the example of 2021, the contribution of breakeven inflation is illustrated well. As the table shows, US CPI grew by 6.8%. While TIPS delivered only 6.0%, the Bloomberg US Enhanced Inflation Index was up over 15%. The additional breakeven exposure allowed the index to react quickly to inflation fears and deliver a greater degree of protection.

Chart 1: Typical sensitivities to interest rates and inflation (US$10m allocation)

Data: Tabula. Interest rate sensitivity and inflation sensitivity are the estimated changes in value of a US$10M allocation for a 1 basis point change in US interest rates or US CPI, respectively. For illustrative purposes only. Sensitivities to inflation and interest rates will vary.

Chart 2: Historical index performance

Data: Tabula/Bloomberg, 31 December 2021. Performance of the Bloomberg US Enhanced Inflation Index prior to May 2020 is simulated by Bloomberg. Past performance (actual or simulated) is not a reliable indicator of future returns. US TIPS is the Bloomberg US Treasury Inflation-Linked Bond Index. US CPI is Urban Consumers Non-Seasonally-Adjusted.

Looking ahead

In 2022, inflation fears remain very real and the inflation outlook is complicated. While some think inflation has peaked, others feel that pandemic-related supply chain issues are not yet fully resolved, and that some price increases have not yet been passed on to consumers. There are also arguments that the market’s current inflation expectations are too low. In the past decade, greater globalisation and low-cost Chinese manufacturing have kept inflation consistently low (around 2% in the US). The next decade could be very different, with waning globalisation, growing trade barriers and an aging Chinese population. For investors, both the immediate inflation concerns and the longer-term expectations matter. There are also US interest rate rises to consider.

Of course, the combination of TIPS and breakeven inflation won’t always outperform. Breakeven inflation is reactive, but that means it can also be volatile. And there are some market scenarios where a pure TIPS index will do better (for example, when inflation expectations are falling). However, for inflation exposure that reacts when you need it to, the combination can be a powerful tool. Moreover, with a liquid index such as the Bloomberg US Enhanced Inflation Index, investors can easily add or remove exposure as their view on inflation changes.

Investing in the index

The Tabula US Enhanced Inflation UCITS ETF aims to achieve the returns of the Bloomberg US Enhanced Inflation Index (H35616US Index), less fees and expenses. It is the only ETF in the market that provides exposure to both realised and expected US inflation. It has over US$90 million in AUM. The fund trades on the London Stock Exchange (USD: TINF LN; GBP-Hedged: TING LN), Xetra (EUR-Hedged: TABI GY), Borsa Italiana (EUR-Hedged: TINE IM) and SIX Swiss Exchange (CHF-Hedged: TINC SE).

About the author

Jason Smith is Chief Investment Officer at Tabula with responsibility for portfolio management and product design. Prior to Tabula, Jason was a Senior Portfolio Manager at Goldman Sachs Asset Management, where he managed fixed income portfolios for institutional clients. Previously, he was Head of Portfolio Management for the absolute return funds at Barclays Capital, receiving both a Citywire ‘A’ rating and Lipper leader award for performance. Prior to that, he managed both fixed income and absolute return portfolios at some of the largest asset managers in the industry, including BlackRock, J.P. Morgan Asset Management, Towers Perrin and IBM. Jason holds a BA in Banking and Finance from the London Guildhall University and a post-graduate diploma in Artificial Intelligence from the University of Westminster.

Tabula Investment Management Limited (“Tabula”) is an independent asset manager and ETF provider focused on differentiated strategies. Its current ETFs provide unique solutions in the fixed income space, with a strong focus on sustainability. Tabula currently manages over US$700 million in assets. Tabula is authorised and regulated by the Financial Conduct Authority.