FOR PROFESSIONAL INVESTORS ONLY

Spotlight on an unexplored opportunity for European ETF investors

Until recently, European ETF investors could only access the Asian US$ high yield corporate bond market via broad Emerging Market or Global ETFs. The new Tabula Haitong Asia ex-Japan High Yield Corp USD Bond ESG UCITS ETF provides dedicated exposure, allowing investors to make more finely-tuned asset allocation decisions. Here, we review the opportunities and challenges this market represents and how the challenges can be addressed.

Love at first sight?

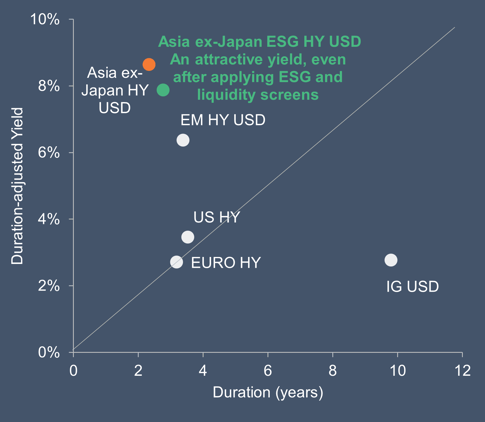

The appeal of the Asia ex Japan US$ high yield bond market is clear. The chart below compares its yield and duration with other fixed income asset classes. Even after applying the ESG and liquidity screens used in the Tabula ETF (green dot), this asset class offers an attractive yield, particularly per unit of duration..

Data: iBoxx indices as at 4 October 2021. Past performance is not a reliable indicator of future returns. Capital is at risk. you may not get back the amount you invested.

Is it still appealing on closer examination?

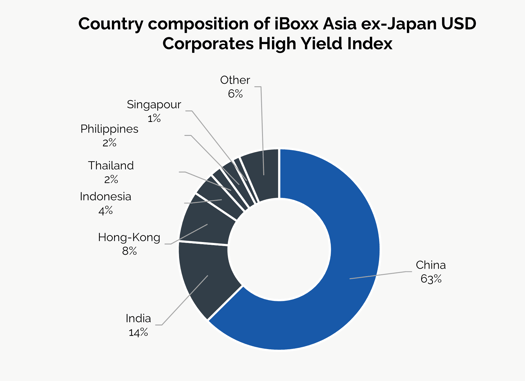

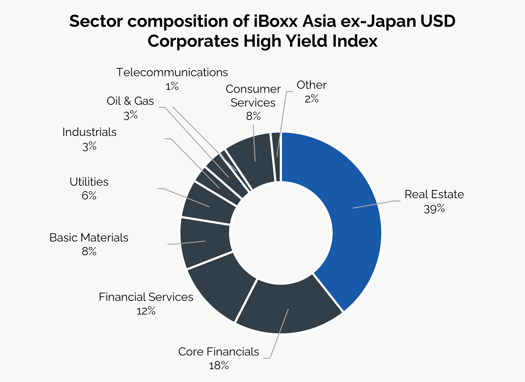

A quick glance at the Asia ex Japan $ high yield market’s sector and country composition reveals that it is substantially different to its European and US counterparts. Firstly, it is concentrated in a couple of sectors and, secondly, it is dominated by China. The country concentration is no surprise. China has the world’s second largest bond market, after the US, and we see even greater concentration in developed market USD high yield indices, with the US completely dominant.

The sector composition is interesting as it shows which sectors are more reliant on, or more able to source, offshore funding. Issuers in the dollar bond market are subject to greater levels of scrutiny from international investors and rating agencies, perhaps suggesting higher standards of governance and transparency. In addition, the sectors that dominate the $ high yield market - real estate, financial and consumer - are all well-positioned to benefit from China’s growing middle class.

Does the concentration matter? For a large allocation, perhaps. However, this market segment can itself act as a diversifier within a broader high yield or income-focused allocation, particularly as China is often at a different phase in the market cycle to Europe and the US. It is also worth bearing in mind that many bond investors are significantly underweight China relative to its position in global bond markets.

Data: Markit, 30 September 2021. Composition is indicative and subject to change.

What about the risks?

Two familiar risks in high yield markets are credit risk and liquidity risk. ESG is also increasingly important – while major rating agencies now aim to capture ESG risk within credit ratings, many investors prefer a higher degree of ESG integration, including some consideration of impact.

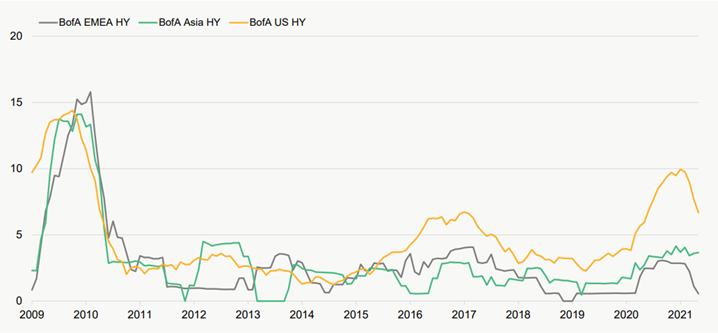

First, we consider credit risk. The Asia ex Japan $ High Yield market proved quite resilient in the early stages of the pandemic, partly because China recovered quickly and partly because it is underweight in the most affected sectors (e.g. energy). As the chart below shows, historical defaults (as a percentage of total notional) in the Asia since the financial crisis have been significantly lower than in the corresponding US and EMEA indices.

Data: Tabula, BofA as of 30 June 2021. Past performance is not a reliable indicator of future performance.

More recently, the Chinese government’s focus on reducing corporate leverage has caused concern and has put some issuers under pressure.

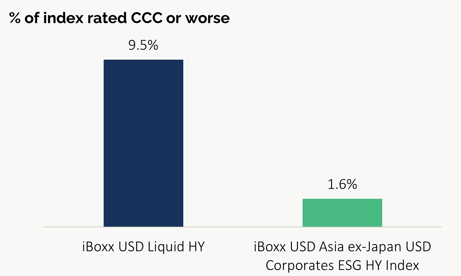

To put this in perspective, it is worth reviewing the credit quality across US dollar benchmarks. As the chart shows, the iBoxx MSCI ESG USD Asia ex-Japan High Yield Capped Index used in the Tabula ETF has significantly lower exposure to the worst-rated issuers when compared to the iBoxx USD Liquid HY Index.

Data: Markit, 1 October 2021. Composition is indicative and subject to change.

Next we consider liquidity. Issuers and issue sizes in the $ Asia ex Japan high yield market tend to be smaller than in Europe and the US, so liquidity is a concern. However, careful index construction can potentially reduce this risk and help ensure an efficient ETF. Bonds in the Tabula ETF must have a bond notional greater than US$250m, a minimum aggregate issuer notional greater than US$400m and a minimum maturity of 1 year.

Finally we come to ESG. Many investors now expect a minimum level of ESG screening in any investment, to avoid issuers with a significant negative impact on people or planet. However, in the Asian high yield market, there is also good reason to consider further ESG integration. In general, Asian companies tend to have lower ESG ratings than their European and US counterparts, suggesting a higher degree of ESG risk . There may also be stronger concerns about governance.

Optimising your exposure

Tabula’s new ETF aims to provide broad exposure to Asia ex Japan $ high yield, while addressing some of the challenges of this market. Firstly, it aims to enhance liquidity by focusing on larger issues and those with a time to maturity of more than a year. Secondly, it implements a robust ESG screen, excluding the most controversial issuers. Finally, it tilts weightings to favour companies with a higher ESG rating and/or positive ESG momentum. Thus, it aims to reduce ESG risk and potentially benefit as companies improve their ESG performance.

The Tabula Haitong Asia ex-Japan High Yield Corp USD Bond ESG UCITS ETF launched on 2 September 2021 and is listed on the London Stock Exchange with ticker TAHY in USD.