4 May 2020

April saw markets rebound strongly as volatility declined from extreme levels and the “new normal” settled in. But considerable uncertainty remains. One thing is clear; the ECB will do everything necessary to get through this challenging time, with ECB president Christine Lagarde tweeting “extraordinary times require extraordinary action”.

The ECB’s €750bn Pandemic Emergency Purchase Programme (PEPP) announced in late March followed hot on the heels of a €120bn expansion to ECB QE, meaning the ECB will buy more than €1.1tn bonds between April and year end.

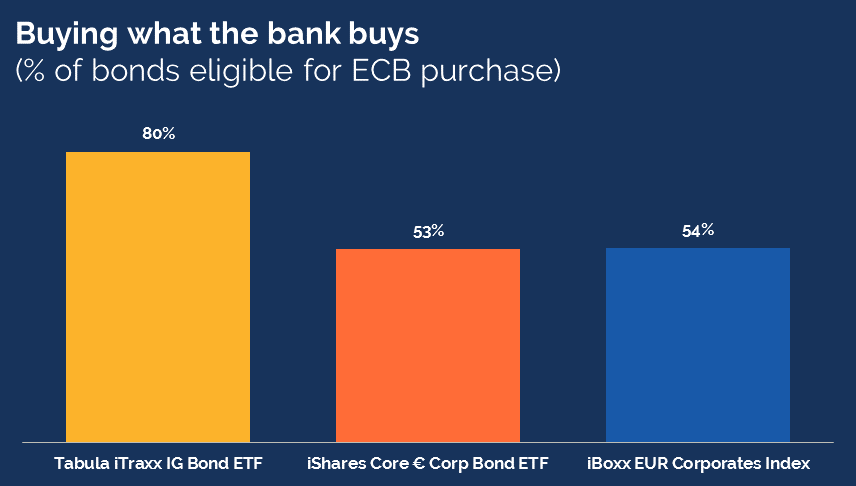

While the bank’s self-imposed political constraints (issue/country limits) were relaxed in April, it is no surprise that ECB bond buying is focused on the larger, more liquid issues. 80% of the bonds held by the Tabula iTraxx IG Bond UCITS ETF (TTRX) are eligible for the programme.

Find out more

The Tabula iTraxx IG Bond UCITS ETF launched in January 2020 and currently has €58m in AuM. The Fund provides highly liquid European corporate bond exposure by combining the robust construction of an iBoxx bond index with the geographic and sector exposure of iTraxx Europe.

|

How did our ETFs perform in April? |

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

|

1 Performance represents the iBoxx iTraxx Europe Bond Index

|