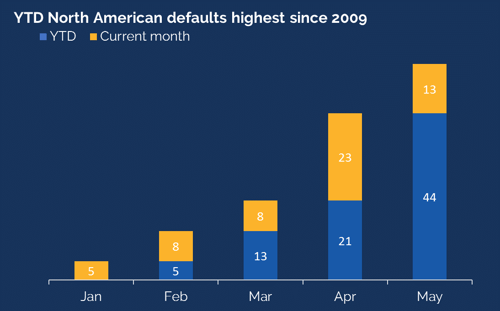

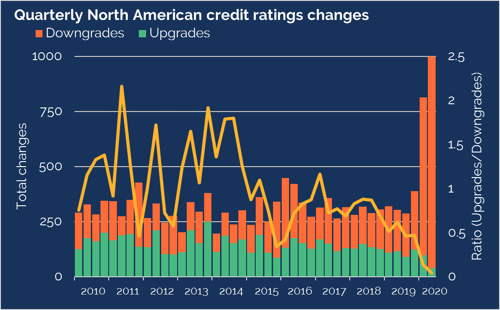

Although both credit and equity have rallied since the end of March, the number of defaults shows that this recovery is fragile. Rating agencies continue to downgrade corporate issuers, suggesting that the pain is far from over.

Whatever your outlook, Tabula’s long and short credit ETFs allow you to increase or decrease your credit exposure efficiently.

Read our latest updates

Tabula signs UN PRI

We are delighted to announce that we have signed the United-Nations-supported Principles for Responsible Investment (PRI). As our business grows, we want to ensure that sustainability and good governance are embedded in everything we do: how we manage investments, how we run our company and how we interact with the community.

Tabula insights: A chance for a green recovery

Covid-19 has led to a dramatic decline in greenhouse gas emissions as travel and general economic activity slowed sharply. However, tackling the climate emergency in a durable way will not come from shutting down the economy as coronavirus has done. It will come only from restructuring the economy to encourage a low-carbon alternative. Tabula senior consultant Gary Smith explores the consequences of coronavirus on climate change.

How did our ETFs perform in May?| Tabula European Performance Credit (EUR) Acc | +2.9% | See the factsheet > | ||

| Tabula European iTraxx Crossover Credit (EUR) Acc | +3.0% | See the factsheet > | ||

| Tabula European iTraxx Crossover Credit Short (EUR) Acc | -3.2% | See the factsheet > | ||

|

Tabula iTraxx IG Bond (EUR) Dist1

|

+0.3% | See the factsheet > | ||

|

Tabula J.P. Morgan Global Credit Volatility Premium (EUR) Acc

|

+4.0% | See the factsheet > |